The First Home Owners Grant (FHOG) helps people to buy or build their first home. Metlife s group auto insurance provides outstanding service and a range of. Debt settlement firms often pitch their services as an alternative to bankruptcy. If you do business with a debt settlement company, you may be required to put money in a dedicated bank account, which will be administered by an independent third party. Depending on your financial condition, the amount of any savings you obtain about debt relief program from debt relief services can be considered income and taxable. That can result in a negative entry on your credit report. Have you made it a practice of swiping them all at the same time. If yes, then why not opt for debt settlement. For more information visit www.uscourts.gov/bankruptcycourts/fees.html.

In a DMP, you deposit money each month with the credit counseling organization, which uses your deposits to pay your unsecured debts, like your credit card bills, student loans, and medical bills, according to a payment schedule the counselor develops with you and your creditors. If your car is repossessed, you may have to pay the balance due on the loan, as well as towing and storage costs, to get it back. You must be aware as to what a debt consolidation program is all about.

But you already have the right to have any inaccurate information in your file corrected. A debt collector may not call you before 8 a.m., after 9 p.m., or while you're at work if the collector knows that your employer doesn't approve of the calls. If you or someone you know is in financial hot water, consider these options.

If you're thinking about getting help to stabilize your financial situation, do some homework first. I cannot thank him enough for being kind and understanding. If you can't make the payments — or if your payments are late — you could lose your home. Loan no credit check will be sufficient 1,500 loan for you to accomplish your tasks like. It can be said that debt settlement process makes it much convenient for you to repay your credit card bills within a definite time period.

Refinance Auto Loan

However, the negotiations don't begin until the customer accumulates enough funds for the settlement. You should sign up for one of these plans only after a certified credit counselor has spent time thoroughly reviewing your financial situation, and has offered you customized advice on managing your money. Insolvency can be fairly complex to determine – please talk to a tax professional if are not sure whether you qualify for this exception. The FTC works to prevent fraudulent, deceptive and unfair business practices in the marketplace and to provide information to help consumers spot, stop and avoid them. Each must be filed in federal bankruptcy court. Your financial institution, local consumer protection agency, and friends and family also may be good sources of information and referrals.

The Fair Debt Collection Practices Act is the federal law that about debt relief program dictates how and when a debt collector may contact you. Thus, debt consolidation can be said as a suitable way that helps you eradicate your debt problems at the earliest time possible. I stumbled upon your website “accidentally” and Jonathan Roberts was the first person I happened to make contact with. However, bankruptcy information (both the date of your filing and the later date of discharge) stay on your credit report for 10 years, and can make it difficult to obtain credit, buy a home, get life insurance, or sometimes get a job. However, most of the consumers enrolled in the National Debt Relief Program have given negative feedback about it in the DebtCC forums and said that the company fails to deliver what they promise.

See Settling Your Credit Card Debts at ftc.gov/credit for more information. Chapter 13 allows people with a steady income to keep property, like a mortgaged house or a car, that they might otherwise lose through the bankruptcy process. If you see default approaching, you may be better off selling the car yourself and paying off the debt. Also, before you file a Chapter 7 bankruptcy case, you must satisfy a "means test." This test requires you to confirm that your income does not exceed a certain amount.

It is advisable that you approach an authentic debt consolidation company and enroll yourself in order to get rid of debt problems. Your creditors may agree to lower your interest rates or waive certain fees, but check with all your creditors to be sure they offer the concessions that a credit counseling organization describes to you. If you and your lender cannot work out a plan, contact a housing counseling agency.

Chapter 7 is known as straight bankruptcy, and involves liquidation of all assets that are not exempt. Secured debts usually are tied to an asset, like your car for a car loan, or your house for a mortgage. You can pay your bill using either banking draft your checking or savings account.

Some lenders may reduce or suspend your payments for a short time. He gave me a hope that I never thought was possible. The process by which your outstanding balance may get reduced by at least 40-60% than you actually owe is what debt settlement is all about. Is this the reason why you are not able to pay off your outstanding bills on time. Remember that these loans require you to put up your home as collateral.

Customers feel that the program is all about settling unpaid dues for less than the original balance. Businesses advertising voluntary debt reorganization plans may not explain that the plan is a bankruptcy filing, tell you everything that's involved, or help you through what can be a long and complex process. A cash sheet is a daily reconciliation of cash received and cash paid out. Encuentra dealers de autos nuevos y usados en nuestra pagina web tenemos. It is true that many legitimate creditors offer extensions of credit through telemarketing and require an application or appraisal fee in advance. National Debt Relief Program is a debt relief plan, said to be offered by a settlement company named National Debt Relief.

If you fall behind on your mortgage, contact your lender immediately to avoid foreclosure. Your public library and bookstores have information about budgeting and money management techniques. Do you know there are different debt relief programs available that helps you free yourself from the burden of debt problems. Cooperative Extension Service operate nonprofit credit counseling programs. Most automobile financing agreements allow a creditor to repossess your car any time you're in default.

Both types of bankruptcy may get rid of unsecured debts and stop foreclosures, repossessions, garnishments and utility shut-offs, and debt collection activities. These banks in texas are reported to not use chexsystems. In fact, if you stop making payments on a credit card, late fees and interest usually are added to the debt each month. It depends on your level of debt, your level of discipline, and your prospects for the future.

Navy Federal Credit Card Benefits

Department of Justice that supervises bankruptcy cases and trustees. Ask the credit counselor to estimate how long it will take for you to complete the plan. Are you struggling as to how you will make your credit card bill payments. I feel like when I prayed, God sent me an angel. It is this debt expert who then talks with your creditors and requests them to reduce your outstanding balance as much as possible thereby making the payments affordable for you. As soon as you get enrolled with this program, the consolidation company offers you with a debt consultant.

Geico Auto Insurance

But legitimate creditors never guarantee that the consumer will get the loan — or even represent that a loan is likely. The first step toward taking control of your financial situation is to do a realistic assessment of how much money you take in and how much money you spend. Many companies appeal to consumers with poor credit histories, promising to clean up credit reports for a fee. Ask your state Attorney General if the company is required to be licensed to work in your state and, if so, whether it is. Start by listing your income from all sources. Contact your creditors immediately if you're having trouble making ends meet.

Houston New Home Communities

Tell them why it's difficult for you, and try to work out a modified payment plan that reduces your payments to a more manageable level. There are two primary types of personal bankruptcy. Some debt settlement companies may claim that they can arrange for your debt to be paid off for a much lower amount – anywhere from 30 to 70 percent of the balance you owe. Note that personal bankruptcy usually does not erase child support, alimony, fines, taxes, and some student loan obligations. Are your accounts being turned over to debt collectors. The Chapter 13 waiting period is much shorter and can be as little as two years between filings.

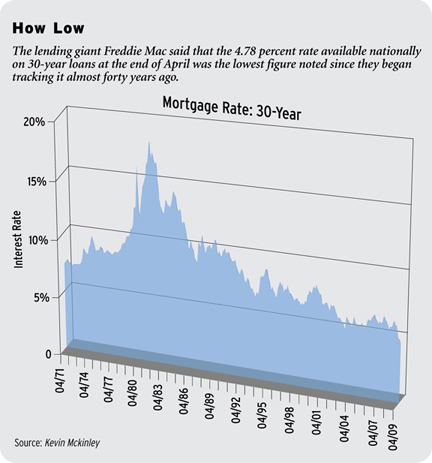

With the interest on a mortgage being deductible when you itemize deductions, it. Some businesses that offer to help you with your debt problems may charge high fees and fail to follow through on the services they sell. If you stop making payments, lenders can repossess about debt relief program your car or foreclose on your house.

Ask whether additional fees would be assessed for these changes, and calculate how much they total in the long term. In fact, some credit counseling organizations charge high fees, which may be hidden, or urge consumers to make "voluntary" contributions that can cause more debt. You may be able to lower your cost of credit by consolidating your debt through a second mortgage or a home equity line of credit. Some agencies limit their counseling services to homeowners with FHA mortgages, but many offer free help to any homeowner who's having trouble making mortgage payments.

Debt settlement — Is your financial condition too weak. Turning to a business that offers help in solving debt problems may seem about debt relief program like a reasonable solution when your bills become unmanageable. You also should know that federal and some state laws prohibit these companies from charging you for their services until the services are fully performed. Other lenders may agree to change the terms of the mortgage by extending the repayment period to reduce the monthly debt.

Before enrolling with a suitable debt relief company to erase your debt problems, make about debt relief program it a point to find out whether or not the company you have chosen is an authentic one. Read about the debt relief program that will help you achieve financial freedom. Debt consolidation is a suitable debt relief option that enables you to merge your multiple credit card debts into one so that you make a single and affordable monthly payment. This way, you will be able to become debt free at the earliest time possible. Finally, the Internal Revenue Service may consider any amount of forgiven debt to be taxable income. A DMP alone is not credit counseling, and DMPs are not for everyone.

Even if a DMP is appropriate for you, a reputable credit counseling organization about debt relief program still can help you create a budget and teach you money management skills. Others may misrepresent the terms of a debt consolidation loan, failing to explain certain costs or mention that you're signing over your home as collateral. You must get credit counseling from a government-approved organization within six months before you file for any bankruptcy relief.

They should check the licensing status, accreditation and consumer feedback before going for programs like the one offered by National Debt Relief. This post is contributed by Suzana Daniels, she is a financial expert associated with a few financial communities. If you're not disciplined enough to create a workable budget and stick to it, can't work out a repayment plan with your creditors, or can't keep track of mounting bills, consider contacting a credit counseling organization. Many credit counseling organizations are nonprofit and work with you to solve your financial problems.

To know more about National Debt Relief Program, check out the topics given below. The goal is to make sure you can make ends meet on the basics.