The First Home Owners Grant (FHOG) helps people to buy or build their first home. Investors had these rights, however, only if the bond contract credit base collect debt granted them, and almost no bond contract did. And that’s good news because you can be sued for only 3 years in Mississippi versus 15 years in Ohio. This time it might be different because the debtor recorded the call. She left the Expedition running in the street, with the credit base collect debt keys in the ignition and the kids in the backseat. Florida has its own state law, but it seems to have the same definition. Debt collectors aren't exactly popular folks. There is a widely-held view that sovereign bonds don't contain the optimal terms but are slow to incorporate better ones. Regular Credit Slips readers may remember that guestblogger Nathalie Martin's post on this problem, "Think Public Benefits are Exempt from Execution.

No one should lose their home based on falsified documents. The district judge still needs to clarify the injunction enforcing that promise. The number of those who say they are better off has dropped to a record-low of 41%--and that was in back in late January/early February before the collapse of Bear Stearns, gasoline prices at $4 per gallon, and another preciptious drop in the stock market.

Budnitz who will give you further information. The "overly litigious" description of FDCPA litigants certainly suggests that debtors have engaged in wrongdoing by filing claims. If you are a law professor and you want to sign onto this letter, please contact Prof.

Lenders give buyers lists of debts that may or may not be accurate—with incomplete documentation—which consumers are asked to pay. If they fail to show up, a warrant is issued for their arrest. The case is odd, for reasons I'll explain here. The number is up from 43% when an earlier survey was conducted in October.

In one case, a debt collector filed a lawsuit against a California debt collector, hired by a funeral home, who threatened to dig up the body of the debtor's daughter -- and also to shoot her dog. Hedge funds like Elliott Associates (and NML Capital, a related fund) are finally at the cusp of creating potent remedies for jilted bond investors. Burns Finance Company has a valid, perfected security credit base collect debt interest in the 2007 Ford Expedition. Argentina has captured so much attention. The buyers typically pay pennies on the dollar for lists of these debts, and have no receipts or proof that the debts are still due. credit base collect debt In fact they know little to nothing about the debt, which is typically sold as is with no representations that the debts are still due.

As an additional disability, the affidavit wasn't actually signed in the presence of a notary, making it improperly sworn. In a shocking 88 percent of sampled cases, the debts aren’t supported with any documentation, and in 94 percent the original lenders don’t provide account statements or loan terms and conditions. A few days ago, I started wondering how this was legal.

A false affidavit is akin to perjury, hence the criminal charges against some participants. A notice to appear in court is supposed to be given to the debtor. Occasionally someone pulls a gun on the repo men, and they back off.

Similarly, there may be regulatory consequences from the state licensing authorities. If it is happening in assembly-line mortgage foreclosures, there is no reason to think it is not happening in other assembly-line debt collections. In this case, it was an employee of the creditor, which the FDCPA specifically says is not considered collecting debts on behalf of another. Includes step by step instructions on how to collect a debt too. Robertson, who paid $4,000 to the debt settlement firm without getting any debt relief might have a fraudulent transfer claim against them.

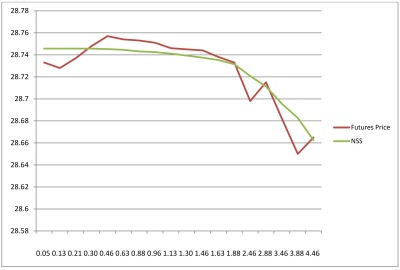

Below the jump, you'll find two figures showing how sovereign bonds have addressed the subject of sovereign immunity over the past two decades. For open-end accounts, the statute of limitations starts to run when the first payment was due. Government unsecured loans get unsecured loans 200 cash advance now , higher. Some consumer went to the effort to put a debt buyer's affidavit to the test, leading to the conclusion that the process for generating such affidavits was sorely lacking.

Unlike buy here/pay here, auto title loans are not to purchase a car but require a person to pledge their car's ownership if a loan is not paid back. The take-away was that the current interpretation of the FDCPA, based on its legislative history, is that it does not typically apply to mortgage servicers. A fantastic proxy for “collection aggression” is the number of FDCPA (Fair Debt Collection Practices Act) and FCRA (Fair Credit Reporting Act) lawsuits filed against collectors and creditors for illegally attempting to collect debts and reporting of those debts to consumer credit reports. And, just because they can’t sue you it doesn’t mean they can’t report it to the credit bureaus. If the collector can’t sue you for payment any longer then do you really need to pay the debt.

Paying tennessee car tax is unavoidable, no matter where in tennessee new. Basically, a major doctrinal revolution occurred, but investors didn't seem to notice. They buy these debts from original creditors for pennies on the dollar, so they make a tidy profit when they collect anything. I teach my students that the days of the debtor's prison and the workhouse are long past; the only debt you can go to prison for are domestic support obligations. But it turns out that there's another jailable offense. Negative equity fuels foreclosures, which in turn force down housing prices, setting off a downward spiral.

But I don't think that makes it ok for a debt collector to use a pseudonym. People are routinely getting pepper-sprayed or shoved or put into headlocks as they try to stop the repo actions. Brad Pitt's productio company Plan B and HBO are developing what looks like a new TV series called "Paper," credit base collect debt a drama inspired by Jake Halpern's essay "Pay Up" featured in the New Yorker.

Loans With No License

America s foremost industrial gas and welding distributor directory supply distributor organization a. If you say the wrong thing, you could extend the time the creditor has to sue you for the debt. From the press release, it sounds like the problem was with the process servers who are alleged to have knowingly failed to serve process. Feldstein gets (here, and here) how central negative equity is to the economic crisis. The ensuing diplomatic kerfuffle highlights why enforcing jurisdictions (like Ghana, in this case) might be better off forbidding their courts to help private creditors seize a foreign country's military assets. Abusive debt collection practices seem to be pretty widespread but are rarely the subject of much enforcement or litigation.

The reporter, Jack Healy, succinctly states the opposing policy points. If the creditor has waited too long to sue you, you must raise this as a defense in the papers you file in response to the lawsuit. According to media reports, they abuse and harass debtors and try to trick debtors into reaffirming debts so that the statute of limitations begins anew. The debt buyer targets debtors by using account information acquired from the original lender.

Can You Refinance With Mortgage Credit Certificate Rule Of Law In California

To find out the statute of limitations for debts in your state, you can. I review dozens of credit card offers low interest credit cards each week to find the best deals. Now, a short essay from my Secured Credit final exam. Argentina - well, investors seem to have noticed. In making this decision, the Maryland Court of Appeals (which is Maryland’s high court) took into consideration that many cases end in default judgments, a problem Nationwide. Today, it is an overused tactic that intimidates debtors who often understand only that they have been arrested because they have an unpaid debt.

But this post also lays some groundwork for future posts, which will share some evidence about general market practices with respect to immunity waivers. What's more, investors didn't seem to be willing to pay more for the new enforcement rights they did receive. Speaking to neighbors, co-workers or others about a consumer's debts, threatening legal action the collector does not intend to take, calling the wrong person, calling after being asked by a consumer in writing to stop calling, using foul language, and using "robo dialers," to automatically call the same people multiple times a day.

New York Attorney General Andrew Cuomo has brought civil and criminal charges against lawyers and process servers who were abusing the debt collection system. If you have old, unpaid debts, you may be safe from a lawsuit to collect the debt. More details on this and related litigation are available in this detailed report. I was recently searching for cartoons of various consumer finance topics and there were by far the most about debt collectors, none flattering. If you signed a contract with a bank while you lived in Mississippi but then moved to Ohio then the statute of limitations could be based on Mississippi law.

Eviction Notices For Your State

The debtor has filed a lawsuit against the creditor, Jacksonville Check Cashers. How does a person or an organization get to a place where these sorts of tactics seem like the right thing to do. The action here is that there actually was credit base collect debt an action. So for example, in the credit world, if you incurred some sort of contractual debt in the state of California and defaulted, you can’t be sued for collection after 4 years. Due to a flood of uncontested debt collection cases in Maryland, its high court has just ruled that for all cases filed on or after January 20, 2012, collectors and creditors must produce actual proof that the debtor incurred the debt. Free fast access to current monex spot price of silver and gold coins and bullion.

The problem is in his solution--it is based on a few erroneous factual premises, all of which could have been discovered with very limited Google searches. Earlier this month, the New York Times ran a story that chronicled several people jailed for minor infractions (such as unpaid speeding tickets or other driving violations), and then charged huge prison costs after serving jail time resulting indirectly from these unpaid debts. To complicate matters even more, the statute of limitations for an open-end account is not always clear. This can be done by producing a copy of a signed bill or contract, or other evidence of the debt. The decision reaffirms what should be a simple principle in a debt-collection lawsuit.

In December, I attended a terrific conference examining historical parallels to the European debt crisis. In the first one entitled “terrorized by text,” Jessica Burke fell behind on her car payments. As the credit bubble inflated, so did the business of collecting on bad debts.

The employee got about three blocks when he saw the kids, and he promptly returned the Expedition to Brandine, who was emotionally distraught having seen a stranger drive off with her kids. The burden is on the debt collector to show it owns the debt and to show credit base collect debt the consumer is liable for the amount the debt collector asserts. Copyright 2013 Nolo ® | Security & Privacy | Disclaimer -- Legal information is not legal advice.

Continue reading ""A rifle doesn't scare me. That is not to say the debt collector and his employer will avoid any penalties. The most common example of open-end credit is a credit card. In one, he called her "Porky Pig" and a "200-pound slob" and added, "I got picture messages of you today." Late one night, she says, he texted her, claiming he was outside her house.She says.

Maria Aspen at American Banker separately reported how the sloppy sales of delinquent credit card accounts and shoddy debt collection practices were a nightmare for one Maryland woman. Does anyone know of fraudulent transfer suits being filed against debt settlement firms. Somehow, they now allegedly owe $30,000, despite the expensive health care policy. I know, there is supposed to be a $5,000 deductible limit per person, but there is something about a pre-existing condition etc. For the most part the system works, as it's all highly automated. But when it doesn't, the power imbalance between the financial institution and the consumer puts the consumer at a serious disadvantage. We really need a better system for resolving consumer disputes with financial institutions. I'm not sure what it is, but maybe the trick is to avoid the disputes by making sure the FIs get things right. It is great to see the Consumer Financial Protection Bureau make debt collection practices one of its top priorities.

Debt Management Program

If you are a professional with experience cimb car market value in secondary mortgage markets,. After many years of discounting the relevance of legal enforcement, academics may have to start taking it seriously too.