The First Home Owners Grant (FHOG) helps people to buy or build their first home. Use this free mortgage calculator to save money on your home loan today. You MUST borrow the maximum Federal Direct Subsidized and Unsubsidized Stafford Loans before applying for a Federal Direct Grad PLUS Loan. Students enrolled full time receive half of the annual amount they are eligible for, thus the loan amount for a full time student is the same for fall whether or not a student is graduating in December. The Federal Direct Subsidized and Unsubsidized Stafford Loans are low-interest loans designed fall semester loans to provide students with additional funds to finance their college education. After the Drop/Swap and Add period ends, all awards will be adjusted to reflect actual enrollment. Failure to enroll as indicated on your award notification may result in the reduction or cancellation of your loan. Know beforehand what your bottom line amount is and dont get caught up in thinking that this will be the only person interested in buying your car. Students Face the Uncertainty of Switching Lenders With over 8 million students and parents having turned to federal college loans in 2006—07, according to the College Board, the number or families that stand to be affected by the ongoing wave of lender departures this year is not unsubstantial.

Even with this legislation in place, however, lenders continue to find themselves forced to suspend their student loan programs. If you are approved with an endorser, you will need to sign a new MPN for each endorsed loan. Full-time and part-time dependent or fall semester loans independent students may apply.

Join aaa michigan today and start saving aaa auto home insurance with special member benefits and. What types of financial aid do you have. Additional information can be found on our Web site under Scholarships.

Total Bankruptcy is considered a lawyer referral service in the state of Florida under the Florida Rules of Professional Conduct. Under this legislation, the Department of Education can buy federal college loans from lenders, thereby providing these lenders with the liquidity they need to continue funding new parent and student loans. The cumulative limit for this additional unsubsidized borrowing is $73,000 and includes any “additional” unsubsidized borrowing as an independent undergraduate.

Students are responsible for paying fees to the transient institution by the deadline date of that institution. The required documents will be listed on your To Do List. Pingback by » Students Scramble to Find Student Loans as Fall Semester Draws … Business Loan Information.

There are exceptions to this policy for master’s thesis and doctoral students. Most schools credit your account once you submit the Stafford Loan promissory note, but do not actually disburse the funds to you until mid semester. Only accepted loans can be used as a deferment. Pingback by Students Scramble to Find Student Loans as Fall Semester Draws … | Money Articles Blog.

Additional information about the Disbursement process can be found on our Web site. UCF must have a valid processed application on file in order for Bright Futures to disburse. The landmark decision would trigger a planned merger between Philippine National Bank (PNB) and Tan's own Allied Banking Corporation.

Choose "Graduate PLUS" and follow the instructions to. Starting in fall 2012, subsidized loans are no longer available for graduate students. To have access to accept loans, all required items on the To Do List must be submitted. I graduated from college right as the economy began to nosedive, so I never experienced this difficulty. Results of jayco toy hauler rvs for sale on rv trader.

One of the predominant factors that lead to the disapproval of online loans is the inability of the applicant to provide the needed and complete information. Effective for 2011-2012, the state legislature passed a law that requires Bright Futures students to file a FASFA each year to receive disbursement of the Bright Futures award. Creditloansources com provides bad credit loans for people who have had. Non-degree students and guest students are ineligible for the Federal Direct Stafford Loan Programs. Once the school disburses the funds your loan money fall semester loans will be used to pay your tuition and fees.

Access to accept, reduce or decline offered loans for fall and spring to the. This is scary news for those seeking higher education. Graduate students can borrow up to $20,500 per academic year in stafford loans. Direct links to these payment options are found in myACCESS, or enrollment forms are available at Registration, Student Financial Assistance or Cashiers offices.

For information on Florida Prepaid College Plan Dormitory/Housing Contract, please visit www.housing.ucf.edu/costs/prepaid. Students who are sponsored by their employer must now pay their tuition and fees first to the College, then obtain reimbursement from their employer per their individual benefit policies. Academic grade levels are determined as follows. Repayment begins within 30 to 60 days of the final disbursement for the academic year unless you defer repayment. You may request a paper MPN from our office; however, processing may take three to four weeks, more than double the time it takes to process online.

Students receiving financial aid (i.e., grants and loans) must enroll in the College’s Deferred Payment Plan. If you pay for your classes with a Federal Direct Stafford Loan and then withdraw from all of your classes, a Return to Title IV Funds refund calculation will be performed to determine what portion of your financial aid received was actually earned. If your application has been selected for Verification, you will be notified by Student Financial Assistance and must submit additional documents.

Another credit check will not be performed if the request is for the same loan term period. Students Scramble to Find Student Loans as Fall Semester Draws …SHARETHIS.addEntry({ title. You are not required to notify the Student Accounts Office that you want to use your prepaid plan. We urge you to view our many modular and manufactured home floor plans as well as our gallery of fall semester loans homes which features several exterior and interior images of our masterfully crafted homes.

We have just added your latest post “Students Scramble to Find Student fall semester loans Loans as Fall Semester Draws Near” to our Directory of Auto Loan. The loan amount on the Student Aid Summary is the gross amount, which includes loan origination fees. Students must be enrolled in a degree-granting program. For annual aggregate borrowing limits, please visit our Web site for additional information. These loans are a type of federal financial aid that must be repaid.

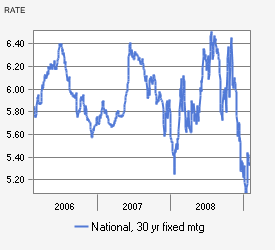

If the interest rates go up, so does your mortgage. You must be enrolled at least half-time during the period that the loan is to cover and be making satisfactory academic progress toward your degree as determined by George Mason University. Deferments allow the student to extend the payment beyond the published due date for tuition & fees and on campus housing.

Additional information about the Verification process can be found on our Web site. If your looking for International Real Estate you should check out largest source for International Property listings. No delays, like the other guys who knew all along that a co-signer would be necessary. All students are required to pay their tuition and fees at the time of registration.

Through a combination of Subsidized and Unsubsidized Stafford Loans, first year undergraduate students can borrow up to $5,500 per academic year; sophomores can borrow up to $6,500 per academic year, junior, seniors and fifth year undergraduates can borrow up to $7,500 per academic year. Once you have accepted your loan and completed your registration, funds will automatically disburse to your student account after classes begin. Tuition and other charges will be deducted. We have just added your latest post “Students Scramble to Find Student Loans as Fall Semester Draws Near” to our Directory of Auto Loan. To request an exception or deferment, a scholarship appeal must be completed prior to the start of the semester.

Many things affect the cost of building a estimated home building costs typical house, but there are three want. Mr landlord is the website for free rental forms do it yourself landlords. I m thinking of getting a used car in penang. The loan amounts will differ on the Student Aid Summary and the Bursar Tuition Bills sections. Any remaining balance is then refunded to the student via direct deposit or a check will be mailed to the address of record.

Banking Draft

Be sure to choose the loan term period from the drop-down menu before submitting. Dual Enrollment is not acceptable for Pegasus Scholarship Programs. All first time borrowers must complete an Entrance Counseling and a Master Promissory fall semester loans Note, which can be done online, before loan funds can be disbursed to the student. Due to the recent passing of legislative changes to the federal student loan programs, all Federal student loans will now be processed through the Federal Direct Loan Program effective with the Summer 2010 semester.