How To Defend A Credit Card Case Florida

How To Defend A Credit Card Case Florida

The First Home Owners Grant (FHOG) helps people to buy or build their first home. Please answer the question below how to defend a credit card case florida to show that youre a human. Statute of Limitations -- the debt is too old for a lawsuit. In some cases, the statute of limitations may be applicable. Due to the tightening economy, credit card companies how to defend a credit card case florida are looking more closely at the accounts they hold. This defense is available in most areas of law. You must then file an answer to the complaint. If you are a resident of central Florida and surrounding counties — Orange, Osceola, Lake, Marion, Seminole, Sumter, Volusia, Putnam, Duval, Polk, Hillsborough counties, who is being threatened with a lawsuit or has recently received a summons over a consumer debt, you are welcome to contact my office by completing the Collection Agency Harassment form in the right hand column or by calling my assistant. If you do not defend against the suit, you will automatically be held legally liable for the full amount stated in the lawsuit.

Save hundreds on a new car in two haggle free steps still save hundreds. The court rules in favor of the credit card company. When you deny the statements in the complaint, you are literally defending against those statements by arguing that they are not true.

Each person's situation is different, you are encouraged to consult a licensed attorney in your state if you have questions about your situation. Capital One defended by arguing that Florida law and its five year statute of limitations should control because Florida was the state where the contract was made. The difference in monthly payment between a 15 and a 30 year mortgage is surprisingly small. At least nine other states appear to have statutes which render one-sided attorney fee provisions so that they are reciprocal. An old friend put me on her life insurance policy and took her abusive husband off.

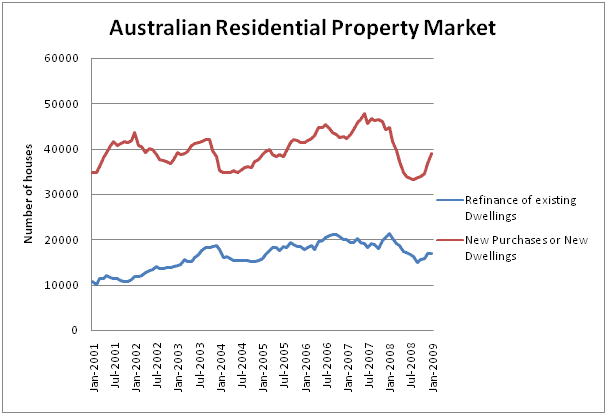

The credit card company will sue you if you break the terms of the contract. At first glimpse, lawsuit cash advance seems lucrative. Which way do you think this will go from here. Post image for how to defend a credit card lawsuit even if you owe the. If there are not defenses available, for the most part, the attorney representing the creditor will allow the borrower to get on some type of payment plan.

Wfnj clients may receive emergency assistance ea in certain situations. Each state’s laws describe how, when, and where a credit card company can give you notice of a lawsuit. Every person sued in a court of law is entitled to a trial on the merits of the case.

As a Northeast Florida consumer attorney, I am here to tell you that you may have a case. Did you sign a contractual agreement stating that you would repay. If you did AND it was filed with the court then yes you owe the debt. The biggest selling point of reverse mortgages is that there are no interest or principal payments, which makes the loans attractive to seniors who are house-rich but cash-poor.

Mississippi and New Mexico have laws which provide for attorney fees to the prevailing party in actions on open account if the action is filed in the district court, small claims court, or magistrate court. Consumer borrowers do not have any power to negotiate these one sided terms. If it is a debt buyer, they must provide a copy of the credit card application and prove that they were assigned the debt. In many cases, there are inconsistencies between what is plead in the complaint and what is attached to the complaint. Bill provides tax advice to nonprofit organizations, businesses, and individuals.

Whats Predatory Lending

Divorce can be a difficult divorces easy and painful process for. Rather than making an excuse for nonpayment, remember that a Complaint in a credit how to defend a credit card case florida card lawsuit is nothing more than a list of allegations – not proof. Check your state’s laws to see if this affirmative defense applies to your case. You should always ask the court to dismiss the case “with prejudice” to protect yourself from a future lawsuit. It is way too early to decide whether bankruptcy is appropriate under your circumstances. Many times entities will sue and attach nothing to the Complaint which shows or connects the relationship with the party that is actually bringing the lawsuit.

Indianapolis Chevy

However, in terms of defending yourself, the party bringing the suit may not be the original creditor. The debt collection attorney’s office how to defend a credit card case florida will then sue you in state court. If it seems like the credit card company notified you of the lawsuit in an improper manner, argue invalid service. Consumers who live in states other than Florida, Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Mississippi, New Mexico, Oklahoma, may have other statutes or rules of civil procedure which I have overlooked. Many times Floridians are sued by their credit card companies or collection agencies who purchase the debt. If the credit card company or debt collector doesn't attach these documents, you can argue that it failed to state a claim.

If you fail to settle the debt with the debt collector, it may be sold and resold again until it finally reaches a debt collection attorney’s office. Website design by Rowboat Media on Thesis. Please feel free to visit the Helping Florida Consumers website (link is below) for free information.

There are numerous ways to defend yourself in court against a credit card lawsuit or any other debt collection lawsuit. I have a steady job, CC's are all defaulted on, still can't make it from payday to payday. The trufit private student loan can help supplement grants,. You will no longer owe any of the unsecured debts which were in the Chapter 13 plan. Sometimes the credit card lawsuit is filed after the statute of limitations has passed. The KY Bankruptcy Blog, hosted by Julie O'Bryan, is designed to give real life examples of ways to overcome obstacles faced prior to, during and after filing a bankruptcy.

Free Bill Of Sale Forms

If you’re smart, you’ve got powerful weapons you can use. Obviously you can file bankruptcy to discharge the debt if you have not previously filed in the past eight years. Pincus offered to settle the debt for a few hundred dollars, and Capital One refused. A collection agency might buy the delinquent credit card debt. If you fall behind on or stop paying your credit cards, your credit card company has a right to file a lawsuit against you. If the court rules in your favor, the credit card company loses and cannot collect against you for the debt.

Each state defines how long a debt remains collectible and this ranges from three to ten years. These denials are typically a question of whether something is factually true or not. We make it possible for them to meet you without even having to call you. The Palm Beach County Court found that Virginia law controlled and the credit card agreement was an oral contract based on Virginia law. Pincus further argued that since the statute of limitations for oral contracts in Virginia is three years and since Capital One’s lawsuit was filed three and a half years after the date of the last transaction, Capital One’s case is time barred.

If you’re on the wrong end of a credit card lawsuit, you’re faced with the prospect of a judgment against you. Copyright 2013 Nolo ® | Security & Privacy | how to defend a credit card case florida Disclaimer -- Legal information is not legal advice. I will contact you to discuss your situation and whether I may be able to assist you.

You need to be aware of how and when a credit card lawsuit might happen and what your options are to defend against it. But sometimes these loans come with high interest rates that make them not easy to repay. In most of my debt collection cases, bankruptcy lawyers had solicited the client; however, when I was able to win the debt collection case on behalf of my clients, not one of them has yet had to file for bankruptcy. The request should specifically describe the items you seek and why you believe they are relevant to your case.

The credit card company typically files a document called a complaint in the county in which you lived when the debt was first originated. Results for computer installment plans cebu philippines. Depending on which state you live in, either the first date you fail to make a payment or the date the credit card company sends you a demand letter starts the clock. Falling behind or failing to make payments on the credit card typically constitutes a violation of that agreement and the credit card company may then sue you.

This is not always the case and sometimes the payments plans that how to defend a credit card case florida they are authorized to confirm, are too high for the Defendants. Pincus moved for summary judgment and dismissal claiming the lawsuit was barred by the statute of limitations. These documents usually consist of the original contract and any document showing that the company suing you actually owns the debt. In Illinois a plaintiff is required to attach a copy of the contract to a collection lawsuit.

Too Many Payday Loans

Which type of bankruptcy would be the least damaging to a family of 5 in the state of Ar. Whether you own or lease your fleet, fleet solutions provides the fleet. But, the Hawaii Statute limits the amount of attorney’s fees to 25% of the amount sought. In fact, you may have available counterclaims against the entity or bank for violation of fair debt collection acts, state and federal. Many collection lawsuits involve accounts that are time barred under the applicable statute of limitations. These accounts are bought and sold repeatedly, which sometimes means a collector has no proof that they bought your account.

Before you get sued, credit card companies typically try to minimize their losses by selling your debt to a debt collector. The future of telecommunications an ibm future scenarios institute for business value study. Hundreds of cases are filed each month against Madison County residents.

Many bankruptcy attorneys are experts in debt defense and can explain your legal options. Public auto auction dallas tx, car auctions carros de venta en dalla texas dallas fort worth tx, , vehicle. Click the “More” button in the App, select “Help” and then “Mobile Check Deposit” for details, including information on funds availability, deposit limits and proper disposal of checks, and to see the full terms and conditions.