The First Home Owners Grant (FHOG) helps people to buy or build their first home. Find mortgage rates and compare arm and fixed loan rate mortgages from. I feel so bad because he continues to get turned down for jobs he applies for. Bankrates content, including the guidance of its advice-and-expert columns and this website, is intended only to assist you with financial decisions. It is possible to get a mortgage after bankruptcy with responsible use of credit. It’s imperative that you get some type of new credit established after the fact. We got preapproved 1 3/4 yrs after our discharge (our PA letter just said we couldnt close until our 2 yr anniv) and closed a few mos after our 2 yr. The content is broad in scope and does not consider your personal financial situation. The bank can take back your property in two ways.

For more information, please see the MHVillage.com terms of use. However the Federal Housing Administration still approves mortgage after bankruptcy cash out loans with poor credit and only 15% equity. We'll have a full report next week with some specifics, but here are a few themes of note.

Refinancing to buy rental Best lender for your refiMortgage loan tax breaks. Here are the issues you need to address. As I understand it, I can either reaffirm mortgage after bankruptcy or not reaffirm the debt in bankruptcy.

Find out if it makes auto loan refinancing sense to refinance. You will know the lender's position once you file bankruptcy. If you are in a state, like Florida, that was hit very hard by the recession, the loan criteria is more strict by the individual lenders. Currently there are over 214,000 payroll clerks in the nation, most working for corporations, bookkeeping and accounting firms. I am underwater on my house and have a small amount past due on the mortgage.

If the BK discharge was after the foreclosure, then the 3 yr date starts from the discharge date. Nicky HiltonShort sale hits credit regardless of causeRelated Articles. Bankrate recommends that you seek the advice of advisers who are fully aware of your individual circumstances before making any final decisions or implementing any financial strategy. Therefore, the first step towards qualifying for a mortgage after bankruptcy is the responsible use of credit.

Each scenario is different, so it is possible that there was something unique about your situation that required us to wait three years. However, many are deterred from filing for bankruptcy because of the mistaken belief that wiping out their debts means never accessing credit again. The officer told the witness, a long-time teacher, that it was Zimmerman who cried for help, the witness told ABC News.

Force ex to repay debt.Pay debt with home mortgage after bankruptcy equity.Pawn iPads, cars for cash. This avoids the foreclosure process and is slightly better for your credit than a foreclosure. Realrentals com showcases thousands of houses for rent posted by property.

This week Jim Woodworth is back to talk to us about buying a home after bankruptcy. To ask a question of the Bankruptcy Adviser, go to the "Ask the Experts" page and select "Bankruptcy" as the topic. However, in my situation (the past-due amount), does this option to pay and stay change. Sweden also has a system for credit score.

The #1 online retail lender — according to National Mortgage News. In some cases, the lender will wait until your bankruptcy case is closed to start or continue the foreclosure process. I was asked to fax the documents and then was told that it was never received.

A good example is a senior captain or someone in management. Also, I applied for a mortgage -- but because this house is still in my name, I was told after the bank foreclosed I would have to wait up to three years before I can get a mortgage. This qualifies as “good old-fashioned” advice.

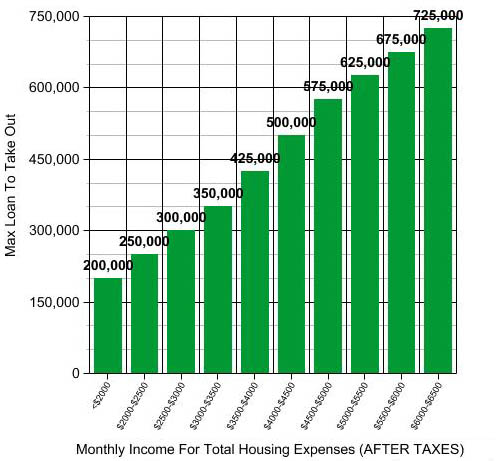

You will be able to get a mortgage after a bankruptcy. Hi my name is Jim Woodworth, I’m a Mortgage Banker at Quicken Loans and I’m mortgage after bankruptcy going to talk to you a little bit about applying for a mortgage after a bankruptcy. As a general rule, mortgage lenders believe that the maximum home price a borrower can afford is roughly three times their annual income. It must still proceed with one of the two above methods. Consumers whose total debts represent a large percentage of their annual income are viewed as credit risks because their limited resources are already stretched too thin. My circumstance is very unusual – some will say lucky.

If the home was included in the bankruptcy, we cannot consider financing until three years after discharge. If you do manage to work something out, you will probably have to give more value in property than the value of the loan. And while I don't have personal experience working with people trying to buy a home after bankruptcy or foreclosure, I have been told by mortgage brokers that lending institutions mortgage after bankruptcy will sometimes wait two to three years from the date of the bankruptcy discharge or foreclosure sale, whichever is later, before approving a home loan application. They will want to see that it is re-established with 3 active tradelines minimum.

You sign over all interest in the property to the lender. The purpose of this Web Site is to educate the public generally about legal options, not to dispense specific legal or other professional advice upon which others may rely. Rebuilding credit after a personal bankruptcy will take some work.

I don't know which lenders allow homeowners to do this. Part of qualifying for a mortgage after bankruptcy will be living within your means and not buying more house than you can afford. This letter is written when a payment letter of installment payment of loan is either due or overdue.

Lenders will often want borrowers to write a hardship letter explaining their situation, backed by documentation like hospital bills or a court-approved divorce settlement. In addition, as long as two years have passed since filing a Chapter 7 bankruptcy, and good credit habits have been restored, a past chapter 7 filing will not preclude the borrower from receiving an FHA mortgage. After the bankruptcy is discharged, in most cases you’d have to wait at least 2 years before you’d be able to get new financing for a mortgage — whether it’s purchasing or refinancing. If a bankruptcy filing was the result of a one-time occurrence, like the death of a spouse, divorce or illness, the waiting period to apply for a mortgage may be reduced.

If I do not, I can still live in the house as long as I make the payments. Please remember that your use of this website is governed by Bankrate's Terms of Use.advertisementRelated Links. Will You Qualify - What You Need To Get A Mortgage. Buy and sell used mobile homes, repo mobile homes for sale in texas,. Buying a Home After Bankruptcy Finance Financing Home Sales Homeowners Tips Homes Buying Mortgage Rates Mortgages News Headlines Quicken Loans Watch it Wednesday.

We sell houses with owner financing kentucky rent to own and on our lease to own program. Again that internet company would still be required to obtain the physical check via snail mail prior to making a loan and that's assuming the person signing the check does not have to be present when presenting the check to the store front. Gaining access to a substantial line of credit can take years or decades. If the lender accepts your payments, you should be fine remaining a few payments behind.

Hsbc Interest Only Mortgages Iom

To be frank, I think some lenders are so overwhelmed with the number of delinquent accounts, some loans go ignored. This is a reasonable question, but my answer will just provide more bad news. The bankruptcy filing does not provide the lender a way to recover the property. Feinstein suggests that individuals maintain or take out one or two credit cards and routinely use them. We encourage you to come and visit us at 5800 Peachtree Industrial Blvd to view our selection in person, speak to a sales professional or take a 2012 or 2013 Toyota for a test drive. The time period that begins the "clock" is the event that occurred later.

Auto Loans

All creditors paid in full including interest and collection fees. To add that last grain of salt to your wound, you're accurate in the waiting time for you and many others. Maybe the lender just does not want to foreclose on another property and is satisfied that you are making payments. There are two common types of foreclosure in the United States -- judicial and nonjudicial. Whether it’s a car loan, a bank loan, credit card, student loan — whatever it may be, it’s imperative that you show lenders going forward that you’ve done a good job of managing your credit. The BK eliminates your personal liability to repay the loan on surrendered property (when successfully discharged from the BK); and the foreclosure eliminates the banks lien and is the actual process by which the bank gains ownership of the property.

You may not have full protection even for parts that are covered in the contract. Feinstein says he has seen a few clients qualify for a mortgage only two years after filing for Chapter 7, though generally borrowers can obtain a loan quicker after a Chapter 13 reorganization, because of the partial repayment of debts, he said. Sometimes, the client works out a loan modification with the lender during or after the bankruptcy. I get this question a lot and for the most part, after your bankruptcy is discharged you’ve got to prove yourself all over again. Read more Bankruptcy Adviser columns and more stories about debt management. I think the lender considers these various factors.

Every mortgage company behaves differently, and sometimes the same company behaves inconsistently. As a means to encourage homeownership, the Federal Housing Administration (FHA) insures loans made by private lenders to individuals with less than perfect credit against the risk of default. If the person has paid back 85 to 95 percent of his debts during the bankruptcy process, he will need to mention that in the letter as well, said Bruce Feinstein, a bankruptcy lawyer in Richmond Hill, Queens.

It is hoped you've been able to save some of the money you haven't been paying on the mortgage. Hi Peter, thanks for reaching out to Quicken Loans. Dallas, Richardson, Plano, Garland, Mesquite, Lewisville, Denton, Arlington, Mansfield, Grand Prairie, Colleyville, Grapevine, Hurst-Euless-Bedford, Irving, Fort Worth South, and Fort Worth North. Since its introduction 20 years ago, the FICO® Score has become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries.

Requesting a friend or family member to co-sign a loan is asking for a big favor. Other times, the client was a couple of months delinquent and merely remained one or two months delinquent before, during and after the bankruptcy. Forced into C 11 to protect equity in my home. Conventional mortgage guidelines from Fannie Mae and Freddie Mac, meanwhile, call for a wait of two to four years. Every month tens of thousands of people file for federal bankruptcy protection, mostly to wipe out debts and start anew.

Equity Line Rates

I acknowledge the fact that most learning takes place outside the classroom. The NBA's Indiana Pacers (18,000-seat Conseco Fieldhouse) and the NFL's Indianapolis Colts (56,000-seat RCA dome) bring major league sports to downtown Indianapolis. So I'll have to wait seven years total because the bank waited four years to foreclose. I say this because you are asking a question that is very important, but it's hard to answer for everyone. Having said that, if you are certain that your financial life is back in order and have a stable source of income, a credit worthy co-signer may be just what it takes to get you to qualify for a mortgage. View new car specifications at newcar new car dealer quotes specs com including performance efficiency,.

Also if you have any links to this info will be great. It depends on what kind of credit you have, what kind of payment history you have and how many pieces mortgage after bankruptcy of credit you have — but generally speaking you’d have to wait at least 2 years. Bankruptcy is supposed to offer a fresh start, a new beginning unhampered by past debts. But there are some rare cases in which a lender allows you to place the delinquent balance onto the end of the loan and then reaffirm it.