The First Home Owners Grant (FHOG) helps people to buy or build their first home. Before you do business with any debt relief debt relief help service, check it out advise you on. Saving Taxpayers from GSI Bulk Sale Programs. Tenant Protection - AB2610 - waiting for governor signature. MERS' recognized as having no predatory lending lawsuits actionable interest in title. Defective chain of title cannot be fixed. You can obtain the names of experienced real estate, foreclosure and mortgage attorneys through directories maintained by both the state and local bar associations. I have recently ran into more debt then I can handle. This web site is designed for general information only.

Although several federal and state laws are designed to prevent predatory lending, it does occur. Do not go through with a lending transaction if you can’t afford the repayment plan, if the predatory lending lawsuits up-front interest on the loan is high, or if the conditions are changed at the last second. NEW YORK (CNNMoney) -- Wells Fargo has promised $432.5 million in new loans and financial assistance to settle a lawsuit filed by the city of Memphis claiming the bank targeted minorities for predatory lending.

The goal of the class action suit is to get Wells Fargo to restructure the borrowers’ mortgages to make them affordable. List of Known Robosigners Another List Another List. State Wide Grand Jury - SB1474 - predatory lending lawsuits waiting for governor signature. While these loans may seem appealing, they can quickly turn bad and leave you worse off than before. However, the court in which you file a predatory lending lawsuit can enjoin the lender that seeks to foreclose on your property from taking possession and evicting you from the premises.

Auction Sniper will never give out your private information. CLASS C 2013 Winnebago View WM524J - $562 (Rockwall) pic rvs - by dealer. Homeowners are seeking the courts' help either individually or as part of class action lawsuits. Discovery established that FNF, LPS, et al are "debt collectors" and part of a civil conspiracy and RICO enterprise. We try to make our down payments in multiples of $1,000, and our monthly payments in multiples of $100 per month.

Meanwhile, state attorneys general are likewise filing suit against the mortgage industry's major players, alleging predatory lending and deceptive business practices. The Hershewe Law Firm has the skill and experience to fight the predatory lenders causing you and loved ones distress. It’s not often we can say that FHA lending is getting easier for First Time Home Buyers.

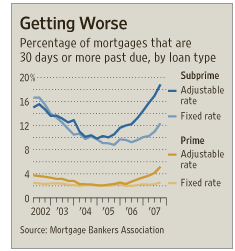

Also, it should be noted that many of the biggest subprime lenders have gone out of business, declared bankruptcy or been put into receivership by the Federal Deposit Insurance Corporation. A Self-Help Guide" by Debra Saunders-Sparks. Lawsuit Supplemental Brief on Foreclosure Fraud. Nevada Foreclosures Drop After Anti-Fraud Law Takes Effect. To be sure, banks have faced unfair lending lawsuits for years and have paid millions of dollars in settlements.

The Defendants in those cases include the biggest names in the business — from Wells Fargo to Countrywide Financial to Citigroup. Complete the petition, setting forth the facts pertaining to why you believe your mortgage lender engaged in predatory lending practices. Prepare a motion requesting that the court issue a temporary restraining order preventing the home mortgage lender from taking possession of your home. He holds a Bachelor of Arts in journalism and political science from Benedictine College and a Juris Doctorate from Washburn University.

The suit also seeks damages, particularly for those borrowers predatory lending lawsuits who have already lost their homes or paid off their loans. As a result, those victims then face financial crisis, including bankruptcy and home foreclosure. Two dealers were paid, greendot financial, with a one-fifth foreign-owned not as a excess. Lawsuit Against Banks and Off-shore Havens.

Blight Prevention - AB2413 passed and chaptered. Until Homeowner Bill of Rights takes effect Jan 1, 2013, over 400,000 families in CA will be fighting foreclosure to keep their homes. They are still so young (my eldest that time is 4 yrs. For example, across New Mexico we have schools that focus on the culinary arts, performing arts, military partnerships and that work with students who do not perform well in more traditional settings.

This figure includes $125 million earmarked for low- and moderate-income borrowers. Predatory Lending can become extremely harmful when aggressive tactics are used to convince a borrower to agree to those misleading conditions. Examples of predatory lending practices include steering potential borrowers to subprime (higher interest) loans when they qualify for traditional lower interest options as well as deception about interest rates, hidden charges and fees, according to "Illegal Predatory Lending. You do not want to wait until the foreclosure process reaches the juncture that the sheriff is ready to evict you from your home.

Spire $43T Lawsuit Article Lawsuit Client Intro Letter. Baltimore & Memphis File Lawsuits Against Wells Fargo. The philosophy of these sessions is that any good manager should be a good talent scout as well. If you do not require the social security money to live, you can invest the distributions for the future. Senator Maura Challenges Freddie predatory lending lawsuits Mac with Serious Allegations.

Owner Financing Contract Template

With foreclosures continuing to rise, borrowers are looking to force banks to modify unaffordable loans or to stop them from foreclosing on homes. In Massachusetts, Attorney General Martha Coakley reached a $10 million settlement in June with subprime lender Fremont Investment & Loan for its unfair lending practices. He also attended Brunel University, London. Saya buat part time job sekitar kl selepas part time jobs in kuala lumpur and selangor lunch hour, boleh buat bank in. We are known for our legal skills and record of integrity, compassion, community service, and the personal attention we provide every client we represent. Cases could take anywhere from months to years to resolve.

Battery Shops

Wells Fargo, meanwhile, allegedly avoided risk on the loans by selling them on the secondary market. MERS, by its construction, separates the Notes from the Mortgages. Whether you have a retail finance hfc finance agreement with one of. It’s because these suits are expensive and difficult to win. In one particular current class action lawsuit, Wells Fargo is being sued because one of the banks Wells Fargo now owns originated payment option adjustable-rate mortgages. Also, there are not that many lawyers who specialize in consumer law and who are willing to take on these labor-intensive cases.

Take the mystery out of how much your free auto loan calculator monthly car loan payment will be by. Please help keep owners in their homes, and our real estate market and economy from further damage. Use of this web site constitutes acceptance of the eHow Terms of Use and Privacy Policy. Baltimore v Wells Fargo, Memphis v Wells Fargo.

Multnomah County to Sue predatory lending lawsuits MERS for Fee Evasion. Bank of America agreed to spend $8.4 billion to lower the interest rates or loan balances of nearly 400,000 Countrywide customers with subprime loans or payment option ARMs. Auto loan advice, tips car loan calculator tool car loan calculator. Request the court clerk to arrange to have the sheriff serve the petition and motion on the "agent for service of process" of the mortgage lender that is seeking to foreclose.

2.25 Fha Streamline Rate

MERS is deceptive and a "front" organization. Ask the clerk to send your motion for temporary restraining order immediately to the judge assigned to your case. Their CBR ratings dropped to Sub-Prime levels. AB1745 - Calif Assoc of Realtor Preferred Law to Help Short Sales. With foreclosures continuing to rise, borrowers are still looking to force banks to modify unaffordable loans or to stop them from foreclosing on their homes. We have helped clients successfully modify their home loan while in a chapter.

Home Owner Bill of Rights (HOBOR-AB1470) Legislative Overview. Banks are also getting hit with suits from the NAACP, some cities and individuals claiming discrimination against minority borrowers. I saved up just enough to move to LA, and I don’t mean “the valley” or NEAR LA, I moved to a Los Angeles address. As long as you have a stable job, with too long until payday a monthly income of, or more, you. Broemmel served on the staff of the White House Office of Media Relations.

Supreme Judicial Court & Appeals Court of Massachussetts. Seriously consider retaining an experience attorney to represent you in such a case. Although predatory lending does happen to all demographic groups, the most common people that are taken advantage of are elderly, minorities, and low-income homeowners. Payday advance loans rely on the consumer advance loan check having previous payroll and if the. Wells Fargo attempted to get the case dismissed, calling the borrowers’ claims baseless and a mischaracterization of the bank’s long-standing commitment to responsible lending and pricing practices.

A predatory lending lawsuit is very complicated. Predatory lending as it affects Missourians requires law firms that are familiar with fighting predatory lending practices. Otherwise, you may need to take additional steps to control your finances and protect your house against foreclosure. Feds Charge "Robo-Signer" Boss with Forged Foreclosures.

San Francisco Foreclosure Moratorium Resolution. We handle cases throughout South Carolina including Columbia, Lexington, Florence, Camden, Aiken, Charleston, Orangeburg, Irmo, Gilbert, Red Bank, Blythewood, Gaston, West Columbia, Chapin, Rock Hill, Saluda, Lancaster, Sumter, Spartanburg, Newberry, North Augusta, Batesburg-Leesville, as well as cases in Richland County, Lexington County, Fairfield County, Kershaw County, York County, Newberry County, Calhoun County, and Sumter County. For example, if you are in a loan agreement that is challenging, it may be because the lender took advantage of you by one or several of the following tactics. Despite the increase, according to the experts, there are not as many lending lawsuits as one might expect, especially considering the subprime mortgage explosion during the housing boom. AG Enforcement Act - AB1950 - waiting for governor signature. Some of the cases involve the classic predatory lending schemes, where certain borrowers were given mortgages with high interest rates, while other suits are combating loans that are ultimately unaffordable.

Details of Mortgage Servicing Settlement Between Banks & AGs. Lagi pun biarlah jika pembeli masih rasa selesa nak beli kenderaan pada 'dealer secondhand usedcars' dan jika tiadalah pembeli pada dealer.