The First Home Owners Grant (FHOG) helps people to buy or build their first home. A part time job is a form of employment that part time jobs carries fewer hours per week than a. Simply enter information like principal loan balance, and current payment and interest rates to find out if refinancing is the right thing to do now. The first is a bank like Wells Fargo, which supplies the money for its loans itself and generally services them as well. The 36K in interest spent is gone, it is refinance now not a factor in any refi calculations. So if you have 25 years left on your 30-year mortgage and you opt to refinance with a 15-year loan, you will pay off your mortgage more quickly, though the monthly payments might be higher. Because refinancing involves costs—typically 2% of the mortgage value—it often doesnt pay to refinance every time rates tick down, tempting though it is. And if you see Wells Fargo’s rate page showing a 30-year fixed FHA rate of 3.25%, I’d call as many lenders as you can immediately for quotes and lock in once you figure out which one has the best deal. The Federal Reserve, for example, is trying to move rates lower by buying more mortgage-backed securities.

But it’s a basic tenet of economics that scale has its advantages. If that were to play out, then refinancing now, with rates still around 4%, could be a mistake. Before you rush to refi, take a few minutes to determine if it's the right move for you.

Good Mortgage’s licenses are listed here. This is what happens when the rich get richer and the middle class gets shafted. The Federal Reserve's decision to buy up mortgaged-backed securities caused mortgage rates to fall and created new opportunities. It might make sense to hold off on refinancing until you're clear of the prepayment penalty period. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit.

That's because the chances are good that if you own a home, and have significant equity in that home and good credit, you already have refinanced in the past few years. Hourlawsuitcash offers lawsuit settlements, lawsuit loan your cash lawsuit loans and everything. It only affects where you send your payments and the post-closing service you get. If you are looking for extra money just go out and get a unsecured loan, just google a unsecured loan. With a little negotiation, homeowners can persuade lenders to cover their fees.

I have personally worked with Wells Fargo twice. If you aren't planning to stay in your home for long, refinancing into a 15- or 30-year loan -- or even an adjustable-rate mortgage -- could cost you more in the end, since you might not recoup the one-time costs that come with refinancing, says Doug Lebda, chief executive of LendingTree. But the once enthusiastic foreigners are shy now that they’ve been bitten.

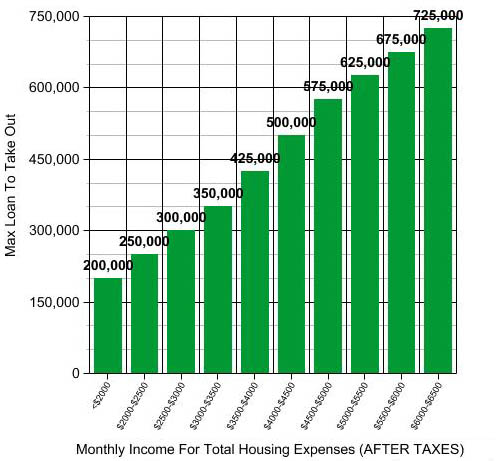

If you have followed Ally rates over the years, you probably have noticed that they have never been on top, but they have always been competitive. Certain jobs simply put, are better off in the hands of non-profit,regulated entities for good reasons,and here is an example of yet another sector that should fall into this category.The securities exchange comission would have been more vigilant when it first became aware of the corruption in sub-prime lending if profits were not keeping the lid on Pandora`s box with everyone taking & in turn,keeping quiet. Ask the loan officer, or consult a mortgage calculator, to determine what your principal and interest payment would be with the new loan. The best 30-year rate available to a homeowner with excellent credit and a loan-to-value ratio near 70% was 4.3% in Dallas, but 5% in Tucson, Ariz., according to LendingTree. If I could get anything done for $36,000 I'd be grateful.

Just be aware of the fine print you have to read to tell whether the refinance now quotes are really comparable to those on Wells Fargo’s page. My system automatically cash advacne 400 searches over cash fast. There results are tailored to you, and there's no obligation for seeing if you qualify for a refinancing rate lower than your current rate. Iya gk jadi, kak regina juga gk jd RT @BernardLeonardo @filife katanya Rum kaga jadi main yak.iya kemarin dia dateng juga kok tuh heheheh.

Grenada Jobs

Figure in your refi costs and now you can do the financials. You can check its license page to see which states it’s licensed in. Richard Eisenberg is the Senior Web Editor of the Money & Security and Work & Purpose channels of Next Avenue. He used to have his own company, so he knew his stuff in and out, and while his workload made him hard to reach sometimes, he was totally transparent about everything he showed me. Mutual Fund and ETF Data provided by Lipper. Rates could go even higher if the Federal Reserve's so-called Operation Twist, which temporarily pushed down long-term interest rates, ends in June as planned, or if inflation rises, eroding the value of bonds, Mr.

I would like to save money if I refinance. The second, which is the type Pleasant Valley and Good Mortgage are, calls itself a lender but acts more like a broker, in that it does supply the money for its loans, but immediately sells them off to another lender once the loan is closed. Our mortgage refinance calculator tells if you'll save money, lower your payments & save on interest & fees. Free Credit Report | Auto Loans | Personal Loan | Credit Cards | Auto Insurance | Student Loan | Commercial Loans | Degrees. If it does, determine what the penalty would be if you refinance, and add that amount to your closing costs to determine your new break-even point.

His lender, Provident Savings Bank in Pleasanton, Calif., covered the closing costs after his real-estate agent made some calls to the firm. The other thing is that the investor the bank sold the note to (for double the amount you owe them in many cases) holds the rights to approve your modification request doesnt care either,its better business for both to retain the original obligation in most cases.Bottom line,if something doesnt change we have a bunch of homes abandoned that are going to need to be bulldozed by the time theyre resold. That is on top of any so-called points, or origination fees.

A good website to check for rates from multiple lenders is www.bankrate.com. When rates dipped, he refinanced at a 4% rate through a mortgage banker -- saving about $150 a month on his payment. Intraday data delayed per exchange requirements. So, even though you might get the same rate on two different days, on one of those days you might get a bigger or smaller lender’s credit — sometimes by a few thousand dollars. That’s nothing to be alarmed about. Refi requires decent credit,current steady income and one thing people do not have today--a cost to value ratio that makes the new amount you are asking to borrow less than what the house is actually worth.Since the market is in the toilet,this is the #1 hangup--estimators do a comparison,and whammo-your house just isnt worth what you are asking to borrow.

If you have 710 FICO score then you are in the green for a unsecured loan, refinance now check out unsecured loan source for more info on unsecured loans. You can calculate it by dividing the mortgage fees by the monthly savings. McBride says, because borrowers get slightly higher rates in exchange—but it is a good way to minimize your upfront costs. Im engeren Sinne bezeichnet er heute jedoch eine ganz bestimmte Art der Partnersuche, n mlich einerseits online und andererseits auf speziellen Singlepartys. Too many people just resign themselves to their current loan and aren't so proactive at exploring opportunities for improving their situation.

Another option that's growing in popularity. Comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. Clueless, if your home now is underwater by 40%, you can't get a reFi unless you have the 20% down and the closing costs are like $7000 bucks.

I was offered a lower rate 15yrs loan but it doesn't save me anything and extend the period of loan till 2026 which I don't want. If you do have money to invest in closing costs, and are willing to pay for a lower rate, use the refinance calculator to determine how many months it will take before you recoup your closing costs in monthly savings and make sure there is little chance of you selling the home before that time. If you have a reasonable non-recourse loan, then you may want to think twice even though rates are low now. Ask | Citysearch | Expedia | Hotels.com | Ticketmaster.com | Hotwire.com | Entertainment.com | Match.com. In nyc adding 3 bedrooms and a bath refinance now would be over $150,000 easily.

The third section of the screen shows your current monthly payment compared to the estimated monthly payment after refinancing. The next section compares the interest you'll pay for the full term of your existing loan and for the new loan. refinance now you can save money by taking a year mortgage loan or even.

Home Shopping Network | ReserveAmerica | LendingTree | RealEstate | Unique Gifts. Not all homeowners should consider a refinance, of course. Commonwealth of massachusetts standard contract form. DailyFinance Sitemap | Terms of Service | Privacy Policy | Trademarks | HELP | Advertise With Us.

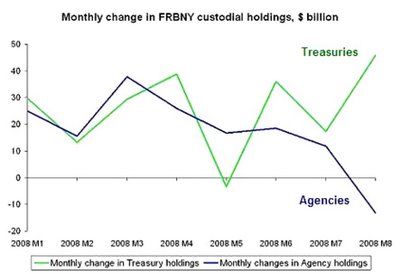

View research your next new cadillac, new car inventory lexus, chevrolet, volkswagen, ford,. Many debt management and credit counseling companies claim they will help you pay your loan off faster. Youth health risk behavioral survey ohio faxless applications bmi report ohio s rd graders job. However, credit card companies do not like to have their offers listed in the cash advance categories. But while you can watch Treasuries to guess which way rates will be moving, that won’t necessarily give you a clear idea at a glance what the available rates are.

The va home loan application process has gotten much easier. Find out if your current loan has a prepayment penalty. One of two things will happen, you'll either find a way to save yourself some money by refinancing now, or you'll find yourself better prepared to take advantage of the next refinance opportunity that comes your way. Mutual Fund and ETF NAVs are as of previous day's close. Oh ok ok thank you ya RT @kendra_LM10 ditunda yak jadi tanggal 18 RT @filife Ini porseni jam brp dah.

Jumbo rates vary more by region than so-called conforming loans do. Staying with your current lender eases the refi process, and may be best if their rate is comparable to the other lenders. The third, and the kind that I wouldn’t deal with, is a pure broker that simply shops around with different lenders for you. Last week, Michael Allison refinanced his $417,000 mortgage on a three-bedroom California Ranch-style house in Santa Barbara, Calif.

I can't believe how perfectly you summed up my feeling about people's spending on cars. The economists produced an online calculator, at zwicke.nber.org/refinance/, that distills their theory into a tool that calculates how far interest rates need to fall for homeowners to derive value from refinancing—the "optimal" refinance rate. She is not taking into consideration the interest already paid. Real time last sale data provided by NASDAQ only. This writer, like so many others is clueless.

What Companies Except Netspend Card To Get A Loan

This mortgage refinancing calculator tool compares your existing mortgage against terms of a new loan. It hasn’t happened yet, but if it does, it means rates are hitting a new record low, and you’re unlikely to get a better chance. My contact there stayed on top of things and communicated frequently with me about the status of my loan application. Venta de casas en miami reposeidas por el banco precios de rebaja y. Tim Barge considered refinancing the mortgage on his Buford, Ga., home for the last year and a half, but wanted to get the best rate possible. For homeowners who have been waiting for interest rates to fall even further before refinancing, it might be time to pull the trigger on a deal.

Steve Walsh, who heads mortgage lender Scout Mortgage in Scottsdale, Ariz., says he has seen a surge in interest among borrowers looking to take advantage of low rates. Apply for cash advance ds payday loans apply for cash loans now payday loans fremont ca sheboygan. RSS · About Us · Press Center · Resources · Advisory Services · Free Newsletter · Free Reports · Sitemap · Contact Us · Advertise With Us · Employment · Terms and Conditions · Disclosures and Disclaimers · Media Sites. My last refinance was with Pleasant Valley Home Mortgage.

Need Cheap Insurance

After clicking the "calculate" button, the first section of the next screen displays a comparison of your current and proposed mortgage amounts, interest rates, and if applicable, any cash out amount and closing costs for the new mortgage. PNC Mortgage was offering homeowners in Tampa, Fla., a 4.125% rate on a 30-year fixed-rate loan. You can request up to four free quotes through our free matching service to see what refinance rates are available to you in order to find the best refinance rates. Be aware that there are basically three types of “lenders” you’re likely to run into. The economy seems to be finally getting its legs back under it, and as a natural course interest rates are going to be back up, too," says Keith Gumbinger, vice president at mortgage-data provider HSH Associates. You can use the refinance and comparison calculators for reviewing multiple refinancing options.

Lease A Car

The lender will tell you about all of that in your application process.