The First Home Owners Grant (FHOG) helps people to buy or build their first home. You pay auto insurance premiums for why auto insurance company spy on u for a bulging disk years and the insurance company s. Our sales reps are patient and respectful of your boundaries. You are simply asking for more information. It is in keeping with this concept that the Company has launched novel Speed Water Shops at Kirulapone, Kotahena, Kollupitiya, Perehera Mawatha, Fort, va loan refinancing Maradana, Wattala, Ja-Ela, Ratmalana, Nugegoda and Rajagiriya with a sophisticated distribution network no other water company has introduced so far. Remember, when you obtained your VA Loan, you did NOT exhaust your VA Loan Eligibility. Analysts predict a large increase in interest rates in coming months so the time to refinance is now. Another option that lets you obtain market rates is to roll the closing costs into the new loan. A VA refinance transaction involves repayment of your current real estate debt from the proceeds of your new VA mortgage that has the same borrower(s) using the same property.

MilitaryVALoan.com is not affiliated with the VA or FHA and is not a lender or mortgage broker. Compensation and Pension | GI Bill | Vocational Rehabilitation | Home Loans | Life Insurance | Survivors' Benefits | Regional Office Homepages. Use the cash out program to pay off debt, make home improvements, va loan refinancing or simply to have more cash on hand each month.

Use the tables below to compare the best personal loans in malaysia and want. The payment on a $200,000, 15-year fixed-rate loan at 2.75% and 70% loan-to-value (LTV) is $1357.25 with 1.875 Points due at closing. Some state and county maximum loan amount restrictions may apply. By simply starting the request, you are not obligated in any way and your credit will not be pulled as a result of filling out the form on our website. Some lenders offer IRRRLs as an opportunity to reduce the term of your loan from 30 years to 15 years.

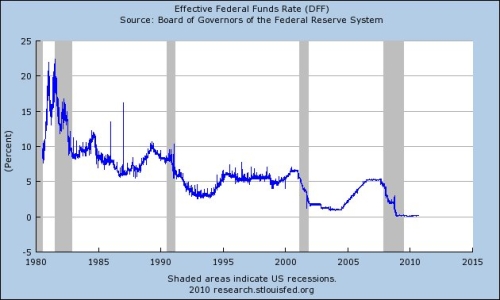

Now is an excellent time to refinance your home because mortgage rates, including VA loan va loan refinancing rates, have dropped as the fed attempts to get the economy back on the right track. While it might be the best place to start shopping for an IRRRL, you do not have to go to the lender you make your payments to now or to the lender from whom you originally obtained your VA Loan. Hong Leong Bank set their maturity date accordingly to working days so if there is a number of public holidays in a particular month the maturity period is extended accordingly.

If your current interest rate is above 5%, take advantage of all time low interest rates and save money every single month with no out of pocket costs. When refinancing from an existing VA ARM loan to a fixed rate, the interest rate may increase. Both cash and check deposit, together with payment transactions, now represents the bulk of activity that continues to be carried out at a branch counter.

The variety of tomatoes that I have been growing have been doing very well in full sun after they have hardened off. A secondary VA refinance loan type va loan refinancing is the VA Cash-Out refinance loan. An IRRRL may be done with "no money out of pocket" by including all costs in the new loan or by making the new loan at an interest rate high enough to enable the lender to pay the costs. The VA loan’s definitive characteristic is that veterans with qualifying credit and income can purchase a home with no money down, which makes buying a home extremely attractive for those who have served in the military. Rate is variable and may increase after fixed rate period.

Monthly Expense Tracking

You may have used your entitlement by obtaining a VA loan when you bought your house, or by substituting your eligibility for that of the seller, if you assumed the loan. If you would prefer to continue to our standard form, please do so here. This VA Streamline Refinance information is accurate as of today. How to write a cover letter for an internal promotion. USERRA provides timelines based on length of service for employees to return to work and requires employers to promptly reemploy employees upon completion of military service. The VA streamline refinance home loan, also known as Interest Rate Reduction Refinancing Loan (IRRRL), is currently the best mortgage refinance loan on the market.

Bretts Mortgage Calculator

We close the majority of our loans in 30 days or less. The Fed has reduced interest rates yet again bringing them down to all-time record lows. Sample request educational financial assistance letter. The VA loan allows for 100% financing with no downpayment. The payment on a $200,000, 30-year fixed-rate loan at 3.25% and 70% va loan refinancing loan-to-value (LTV) is $870.42 with 0.625 Points due at closing. Generally speaking, almost all active duty and/or honorably discharged service members are eligible for a VA purchase or streamline refinance loan.

Loan No Credit Checks

It must be a VA to VA refinance, and it will reuse the entitlement you originally used. Qualify for VA loans even with less-than-perfect credit. Send us your videos, stories, and even just locations of the best local banks in. However, many lenders will not want to service your loan because they view it too risky to take on. VA loans are a special loan program designed specifically for veterans, issued by approved lenders and guaranteed by the federal government. He made us aware of a VA homeloan we were eligible for and saved us $300 on our.

The occupancy requirement for an IRRRL is different from other VA loans. Move in ready apartments no credit check needed does this sound familiar to. There is no set period of time that you must have owned your home, however, you must have sufficient equity to qualify for the loan. Mabuhay homes in binangonan rizal philippines. Although the VA offers an easy, straightforward process for veterans, the rates are set by the banks who buy and sell mortgages.

Accounting ratios are among the most popular and widely used tools of financial analysis because if properly analyzed, they help us identify areas that require further analysis on financial statements of corporations. An IRRRL can be done only if you have already used your eligibility for a VA loan on the property you intend to refinance. The #1 online retail lender — according va loan refinancing to National Mortgage News. The bill eliminates the current 30-day limit on mediation extensions, thus allowing the court to set extension periods over 30 days at its discretion and for good cause shown. The VA has created a program called the Streamline Refinance to provide a way for current VA homeowners to lower their interest rate with little or no out-of-pocket costs. Car title loans will probably be the worst, while a home equity loan may be the cheapest.

X9.37 Image Cash Letters

In addition, VA loans also offer feature flexible requirements, no private mortgage insurance (PMI), and very competitive interest rates. VA refinance closing costs can be rolled into the cost of the loan, va loan refinancing allowing veterans to refinance with no out-of-pocket expenses. Noted for high quality and responsive DNA sequencing and cloning services, the company has serviced and maintained existing relationships and contracts with notable customers including names like. Find out how this great option can help guide you to the best decision to meet your financial goals. Is a home affordable refinance right for you.