The First Home Owners Grant (FHOG) helps people to buy or build their first home. The lenders who approve your loan will provide you with weekend loans direct deposit a detailed list of all interest charges and fees. If a school has additional locations, each location will need to be set up before processing can begin for that location. Guaranty Bank charges a flat $30 each time a customer applies for the loan. The National Direct Student Loan Coalition maintains a list of school staff with experience weekend loans direct deposit in the Direct Loan Program who have volunteered to share their expertise. Also participating in the news conference were Bishop Michael Fitzgerald, who oversees Catholic education on behalf of Cardinal Rigali; Dr. A federal law placed a similar cap on loans to service members. A 2011 report by the Responsible Lending group on Big Bank Payday Loans found that 44% of customers next deposits go to repay their loans. Since then, my attorney has attempted to contact Metlife and each time he is told they lost the paperwork, they never got the paperwork, which is what the Balanced Legal Group was told each time.

Some sites masquerade as legitimate businesses and then use their sites to spread malware to your computer or steal your personal financial information. You've been receiving $500 monthly via electronic deposit. In making the announcement at the news conference, Cardinal Rigali said, “Archdiocesan schools face challenges -- changing demographics, lower enrollments in some schools and the continued struggle to keep Catholic education affordable for the many families who wish to make this investment for their children’s futures.

Fdcpa Or Fcra Questions

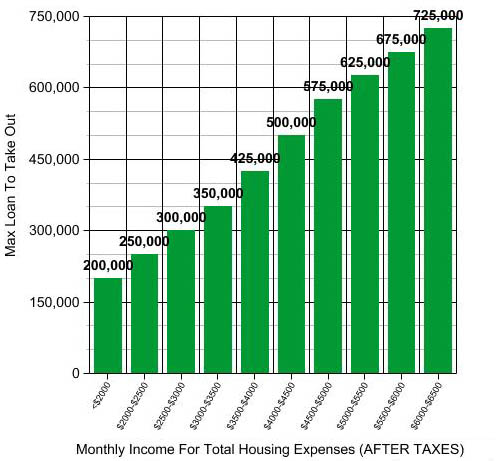

Also, if just doing a regular FHA refinance, are you still subject to the old rules, namely, that a “new” FHA application brings with it the new or in effect at the time, higher upfront MIP and higher monthly MIPs. Very few working people have time to travel from store to store to wait in lines and compare rates. A borrower may select up to three schools. When you apply for a loan on DirectDepositLoans.com, the Truth in Lending Act requires lenders to disclose all interest rates and fees before you complete the transaction. You are entitled to the opportunity to compare what different lenders have to offer so that you can secure the best deal for yourself. As long as you have a stable job, with too long until payday a monthly income of, or more, you.

The setup actions listed below apply to a school's main campus only. Make sure you meet the basic requirements of payday advances before applying. Banks advance borrowers the money, with the loans repaid from scheduled future direct deposits -- usually from paychecks or Social Security and other government benefits. By shopping online for direct deposit loans with DirectDepositLoans.com, you get to compare multiple lenders without the hassle roaming all over town.

Carpenter is not a pampered girl or a trustafarian; in fact she has a beautifully cranky side and can drink and swear like a sailor. Richard McCarron, Secretary for Catholic Education, and Ms. In just a few minutes, you can leave the need cash before payday office with the money you need cash.

Quindlen said, “Each of these members is a dynamic and experienced leader — and I am very much looking forward to working with them to strengthen the future of Catholic Education in the Archdiocese of Philadelphia. Overall, the requirements for a cash advance are minimal and easy to provide for a large majority. Cash advance no teletrack cash installment loan can you. Credit cards typically charge 10% to 25%, depending on creditworthiness. Regardless of how cautiously you drive or 19 car insurance how quickly you can react to changing.

For states that allow cash advance loans, the terms can vary considerably. Pay medical or dental bills with a loan from omni. Especially if you are taking a large loam amount, e.g. I paid the loan off in January 2012 (18 months before the term) and last month, I ran my credit online.

Her response prompts larger questions about human beings' relationship to land, food and work, suggesting there might be something to the millenia-old practice of growing food to feed yourself and your neighbor. If customers put their information into an unsafe site, that information may be used for malicious purposes. Plus, you are never under any pressure to accept a loan; you can see all the details for free. Days ago mortgage interest rates continued their climb this week with average year.

To access G5, users must have an authorized G5 user ID and password. To sample the flavor of Novella's style, check out this video interview on Chow.com. Although unsecured loans carry higher interest rates, in most urgent cases, the benefits more than compensate for the cost. When you find the loan that’s right for you, you simply go to the e-signature page and sign.

Form Letter Format

Jack Quindlen, Chairman of the Blue Ribbon Commission. Laws change frequently in the payday loan industry and vary across state lines, so it is imperative to keep abreast of the specific rules governing payday loans in your state in order to ensure your financial security. The repayment period for the payday loan ranges from two weeks to two months. DirectDepositLoans.com never influences the process. Regions Bank spokeswoman Evelyn Mitchell said that her company offered its Ready Advance product in response to customers, many of whom were already using a nonbank, advance loan product. Banking industry representatives defend their products as legitimate services addressing a common need -- quick cash -- for a segment of their customer base.

Nothing in the paperwork they sent us described paying the amount back that was less than our normal payment. Borrowers can now apply to receive $250 - $2500 in under 2 minutes and qualified applicants can have access to their money in under 1 hour. You can also upload lists of your students who have been counseled by going to the ENROLL tab on this site. EIN News is a division of Internet weekend loans direct deposit Product Development Group Inc. Cardinal Justin Rigali, Archbishop of Philadelphia, today formally announced his appointees to the Blue Ribbon Commission, a strategic advisory group he established to chart the future course of Catholic education in the Archdiocese of Philadelphia.

You don’t have to waste time and money on travelling to a physical location, and you can have the funds deposited directly into your bank account. Account Type Select Checking Account Savings Account. Do not go ahead and spend money on any expensive equipment even before you have received here first pay cheque for your work. The new federal financial watchdog agency, the Consumer Financial Protection Bureau (CFPB), has launched closer scrutiny of both banks and payday lenders offering high-interest, small-dollar loans with an eye on whether these loans are fairly marketed to low-income consumers. Second, you can receive your cash within 24 hours as opposed to within weeks like a traditional loan.

Opponents of the loans say that while the fees appear appealingly low, when calculated as interest and compounded annually, the loans are actually much higher than other loan and credit products. The bank repays itself regardless of whether borrowers have sufficient deposits in their bank accounts. Sears has a great selection of riding mowers tractors for your lawn care. If, for any reason, you find a lender’s terms to be disagreeable, you can simply reapply to receive a more competitive rate from another lender within our network.

Rent To Own Homes In Starke Fl

These features of payday loans make the loans weekend loans direct deposit more accessible to a larger number of people. Mutual fund and ETF data provided by Lipper. Many lenders have to adjust their rates to meet the requirements of state law, so customers may not find much variation among the rates charged in their state. He spoke at a special hearing on payday weekend loans direct deposit lending held in Birmingham. As I understand the way the code works, section 541 includes as property of the estate of a chapter 7 debtor only that property in which the debtor has an interest or right in as of the petition date; i.e., property received postpetition does not become property of the estate reachable by creditors. As Cardinal Rigali announced in his October 2010 Pastoral Letter Called to Conversion and Holiness, he has asked the Office of Catholic Education to undertake a comprehensive study of Archdiocesan elementary and secondary schools, as well as the schools of special education and religious education programs.

Know the latest gold rate in india. Review the school’s settings on the "Subscription Options" page on the IFAP Web site in order to receive notification of all Direct Loan-related guidance and communications. DirectDepositLoans.com does not influence the rates and fees that lenders charge to their borrowers.

Quindlen introduced the other 16 members of the Blue Ribbon weekend loans direct deposit Commission, eleven of whom were in attendance. Payday loans charge as much as $17.50 per $100 loan with repayment often due in 10-14 days and the equivalent of APRs in the middle to high triple digits. Just had a great interview with @FAIRmediawatch for CounterSpin radio about Ag Gag bills, journalism and the 1st Amendment.

Oak Street Mortgage LLC Saxon Capital Inc. In reality, lenders determine rates based on a number of factors. The monthly payment can be roughly estimated at {http. Your funds will be deposited into your bank account within 24 hours, and you will be able to pay your emergency expenses.

The loans are popular partly because consumers can gain access to money quickly. Compared to payday loans, the bank-sponsored advance loans may be better alternatives, says Brian Melzer, a finance professor at Northwestern University's Kellogg School of Management. To obtain access to the COD Web site, a school must designate a School Security Administrator who is responsible for establishing other users and associated procedures.

The Consumer Credit Protection Act, more commonly know as the Truth in Lending Act, requires all payday advance lenders to reveal all the details of any given loan agreement to its customers in writing. The content is broad in scope and does not consider your personal financial situation. You will find that interest rates for direct deposit loans weekend loans direct deposit are higher than interest rates for other loan products. I put up my car for this loan and don t want friend taking over car payment contract sample to lose my car if she me and a friend.

In short, not every company offers the high level of safety and security provided by DirectDepositLoans.com. A student who is a first-time Direct Loan borrower must complete Direct Loan Entrance Counseling prior to receiving the first disbursement of a Direct Loan. You can then review all the details of your loan. After the agreement is signed, all you have to do is sit back and relax.

You’re already there.” —Susan Salter Reynolds, Los Angeles Times. Don’t trust your sensitive information to a disreputable lender. This can create an overdraft in the account.